.. a Combined Statistical Area (CSA) is a group of two or more adjacent metropolitan areas; they include contiguous metro counties that have demographic-economic affinity. These 172 areas (September 2018 vintage) are important in wide-ranging geographic and demographic analysis. Based on the 2018 population estimate, these areas include 256.2 million population of the total U.S. population of 327.2 million (78.3 percent). CSAs are at least two adjacent metropolitan areas — reflecting a larger and broader market/service/impact assessment area. Due to their size (of many), it is often possible to develop more detailed custom demographic-economic estimates and projections than at the county or metropolitan area level. See more about CSAs in this related Web section.

Patterns of 2018 Population by 2018 CSA

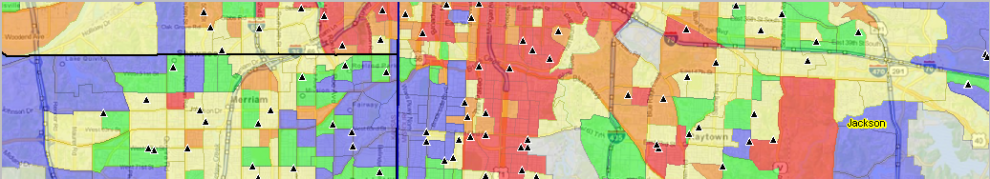

The following graphic shows the September 2018 vintage CSAs based on the 2018 official population estimates. The intervals/colors are depicted in legend panel at left of map window. Create custom maps similar to this view for your regions of interest. Use the GIS project/datasets to examine alternative patterns such as percent change for different time periods. Set queries to include CSAs by peer group. Click graphic for larger view with more detail; expand browser window for best quality view. Larger view shows CSAs labeled with percent population chnage 2010-2018.

– view developed with CV XE GIS software and related GIS project.

Use the GISproject and datasets to examine CSAs in a mapping and geospatial analysis context. The database includes all CSAs and the subject matter described below.

Using the Interactive Table

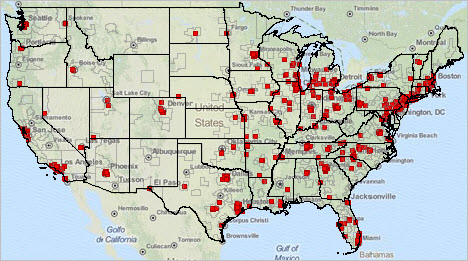

Use the interactive table (opens new page) to examine patterns and relationships among CSAs of interest. The following static graphic illustrates how the table can be used to rank or query CSAs and display selected columns. Selecting population change columns and ranking in descending order on population change 2010-2018, shows that the Dallas CSA had the largest population … it also shows this CSA was the 7th largest CSA based on 2018 population and 9th on percent population change 2010-2018 … use the table to determine which CSA ranked first on percent population change 2010-2018.

– click graphic for larger view.

Data Analytics Web Sessions

See these applications live/demoed. Run the applications on your own computer.

Join me in a Data Analytics Lab session to discuss more details about accessing and using wide-ranging demographic-economic data and data analytics. Learn more about using these data for areas and applications of interest.

About the Author

— Warren Glimpse is former senior Census Bureau statistician responsible for innovative data access and use operations. He is also the former associate director of the U.S. Office of Federal Statistical Policy and Standards for data access and use. He has more than 20 years of experience in the private sector developing data resources and tools for integration and analysis of geographic, demographic, economic and business data. Contact Warren. Join Warren on LinkedIn.