.. effective late May 2023, stakeholders (all of us) now have access to the Census 2020 decennial population and housing data. More than three years after the reference date for Census 2020, detailed demographic data are now available to better understand demographic characteristics for a very wide range of geography to the census block level. Visit our Census 2020 data access and use section, updated continuously, to facilitate more effective use of these data.

While the Census Bureau released the Census 2020 “P.L. 94-171” redistricting data two years ago, the new “Demographic and Housing Characteristics” (DHC) data contain much more extensive data. For example, the P.L. 94-171 data contains no gender data. The P.L. 94-171 data has only one age break — 18 years and over. The DHC data, the focus of this section, includes data by single year of age 0, 1 .. 110 and over iterated by gender and race/origin. And much more.

Get started accessing Census 2020 data now. Use this API link to access Census 2020 data on the size of the urban and rural population by county. Clicking that link opens a new page showing a row for each county with the urban and rural population. The first data row (row 2) shows that in Bullitt County, Kentucky, the total population was 82,217 with 58,002 urban and 24,215 rural. The state+county FIPS code is 21029. From here, build a spreadsheet file or geospatially map/analyze these data. More on this, step-by-step, in the next Census 2020 blog.

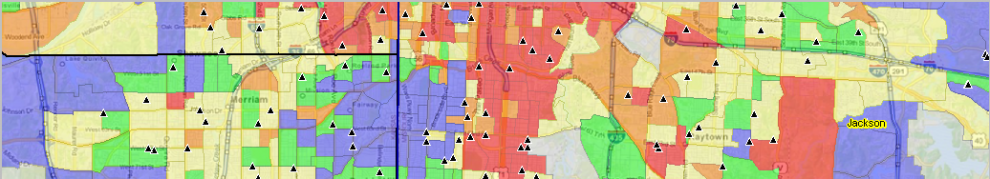

Examine the distribution of Millennials by census tract using Census 2020.

The following view illustrates use of DEDE to extract Census 2020 single year of age data and then create a thematic pattern map showing the distribution of percent Millennials by census tract. in the New York region. This static view is a snapshot of using VDA GIS tools to map these patterns nationally. It is evident from this view that Millennials are smaller part of the population in the Bronx, Queens, and south Kings County. Further insights are available. This matters, for example, in knowing about the where and how the Millennial population is distributed for analyses of the voting population and prospective outcomes. Many similar applications.

Comparing ACS with Census 2020 Data

Aren’t the American Community Survey 2021 (ACS2021) data more recent than the Census 2020 data? In general, no. The ACS 2021 data (the now most recent ACS-sourced data) are tabulated for 2021 only for selected types of geography with 65,000 population and over — the ACS 1-year data. For most counties, most cities, most school districts, all census tracts, all ZIP Code areas and other geography .. only the ACS 5-year estimates are available. These estimates are for the five-year period 2017 through 2021 .. centric to mid-2019. Two-thirds of the ACS 2021 respondents are pre-pandemic.

Comparing ACS with Census 2020 Data – Subject Matter

The ACS data include a much richer set of demographic subject matter compared to Census 2020. For example, ACS includes income, education, employment and data on many other topics. This compares to the more limited subject matter covered by Census 2020 — population, age, gender, race/origin, housing units, selected housing unit attributes. ACS estimates are all subject to sampling and related estimation errors. Census 2020 data are counts. Many ACS estimates are suppressed, and the data item value is not available (such as median household income for a census tract). There is no suppression with Census 2020 data — the data can always be aggregated (for example, the sum of census block group items for an entire county or state).

Census 2020 provides single year of age data by gender by race/origin for census tract and higher level geography. ACS provides data for selected age groups. As a result, only using the Census 2020 data can we tabulate point, one year, data on the number of Millennials and Generation-Z population groups.

Comparing ACS with Census 2020 Data – Geography

The ACS smallest area of data tabulation is the block group. The Census 2020 smallest area of data tabulation is the census block. One advantage of the Census 2020 census block data availability is the size being smaller, more granular than a block group. Possibly the more important use of census block data is the ability to aggregate custom sets of blocks into an aggregated area such as Congressional Communities or user defined study/service areas.

Accessing/Using Census 2020 Data

The Census Bureau provides the online service data.census.gov and the Census Bureau API access the Census 2020 data. The Demographic-Economic Data Explorer (DEDE enables users overcome some limits of the Census API and create Geographic Information System GIS friendly datasets. The Visual Data Access (GIS) tools provide immediate online access to Census 2020 data with only a browser — enabling mixed subject matter and geography for a wider range, or basic, applications/analyses.

This graphic illustrates use of VDA Web GIS to show patterns of the age 17 population by block (salmon colored blocks, label with population 17 years or age) in Newport Beach, CA. Create maps like this for other areas. Login and start now .. select the County/Regional Trends project.

About VDA GIS

VDA Web GIS is a decision-making information resource designed to help stakeholders create and apply insight. Use VDA Web GIS with only a Web browser; nothing to install; GIS experience not required. VDA Web GIS has been developed and is maintained by Warren Glimpse, ProximityOne (Alexandria, VA) and Takashi Hamilton, Tsukasa Consulting (Osaka, Japan).

Data Analytics Web Sessions

Join us in the every Tuesday, Thursday Data Analytics Web Sessions. See how you can use VDA Web GIS and access different subject matter for related geography. Get your geographic, demographic, data access & use questions answered. Discuss applications with others.

About the Author

Warren Glimpse is former senior Census Bureau statistician responsible for national scope statistical programs and innovative data access and use operations. He is also the former associate director of the U.S. Office of Federal Statistical Policy and Standards for data access and use. He has more than 20 years of experience in the private sector developing data resources and tools for integration and analysis of geographic, demographic, economic and business data. Join Warren on LinkedIn.

You must be logged in to post a comment.