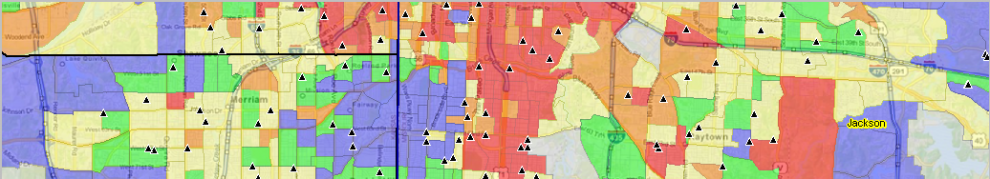

.. make reference and geostatistical maps using the VDA Desktop GIS online via our Remote Desktop Service. Perform simple, easy-to-use mapping tasks, or more advanced geospatial analyses. VDA .. Visual Data Analytics. GIS .. Geographic Information Systems. Here I review how to do this with only Internet and most any device. VDA Desktop GIS and associated “Base” project provides access to the Federal Statistical System and much more.

New York Congressional District 08 by Congressional Community .. an example

.. CD NY08 with CCs labeled with %Majority Minority .. click for larger view

How to use Remote Desktop Service Remote Desktop was envisioned as a protocol to connect a user’s desktop/device via Internet to a remote computer so that the user could access, run, use their files on the remote computer. Remote Desktop Service (RDS) provides far greater capabilities. In our case, we have installed VDA Desktop GIS (VDAD) on the Server enabling a user to run VDAD as if it were operating on the user’s computer. This enables a user to run VDAD 1) without installing anything and 2) using VDAD, a Windows-based program, on Macs, iOS and other devices.

Using VDAD with Remote Desktop Service

Start Remote Desktop Service. If this is the first time used, after starting RDS click the Add PC on the RDS interface, then key in the Server IP address .. 50.62.180.232. Next click the Server graphic. Next login using your userid and password. If needed, register here to get your userid and password. No fee. After logging in, click the VDAGIS icon to start VDAD.

VDAD Start-up View

Start up view shows counties; 48 contiguous states .. click for larger view

See more about using VDAD via RDS

Updates on using VDA Desktop GIS will be included in forthcoming Blogs.

Don’t miss out! Click Follow in button at upper right.

About VDA GIS

Use VDA GIS tools to meet wide-ranging mapping needs and geospatial analysis. VDA Desktop GIS and VDA Web GIS have similar features that can be used separately or together. Each is a decision-making information resource designed to help stakeholders create and apply insight. VDA Web GIS is access/used with only a Web browser; nothing to install; GIS experience not required. VDA Desktop GIS is installed on a Windows computer and provides a broader range of capabilities compared to VDA Web GIS. VDA GIS resources have been developed and are maintained by Warren Glimpse, ProximityOne (Alexandria, VA) and Takashi Hamilton, Tsukasa Consulting (Osaka, Japan).

Data Analytics Web Sessions

Join us in the every Tuesday, Thursday Data Analytics Web Sessions. See how you can use VDA Web GIS and access different subject matter for related geography. Get your geographic, demographic, data access & use questions answered. Discuss applications with others.

About the Author

Warren Glimpse is former senior Census Bureau statistician responsible for national scope statistical programs and innovative data access and use operations. He is also the former associate director of the U.S. Office of Federal Statistical Policy and Standards for data access and use. He has more than 20 years of experience in the private sector developing data resources and tools for integration and analysis of geographic, demographic, economic and business data. Join Warren on LinkedIn.

You must be logged in to post a comment.